However, credit score will certainly have less of an effect on FHA home mortgage rates than it does on standard finance prices. That means while you start out with a reduced rate of interest and repayment, both can raise in the future if prices begin to climb. These car loans are a great deal riskier than fixed-rate mortgages, which guarantee your rate and also monthly payment will certainly remain the same.

- On the various other hand, if you put much less than 10% down, MIP is needed for the whole period of the home loan.

- That said, depending on your credit score and also cash books, some borrowers can still certify with a DTI as high as 50%.

- All lendings undergo customer conference FHA authorization standards.

- If you do not fulfill the FHA finance demands, you may have other government-insured choices with also lower down payments of 0%, consisting of USDA loans and VA financings.

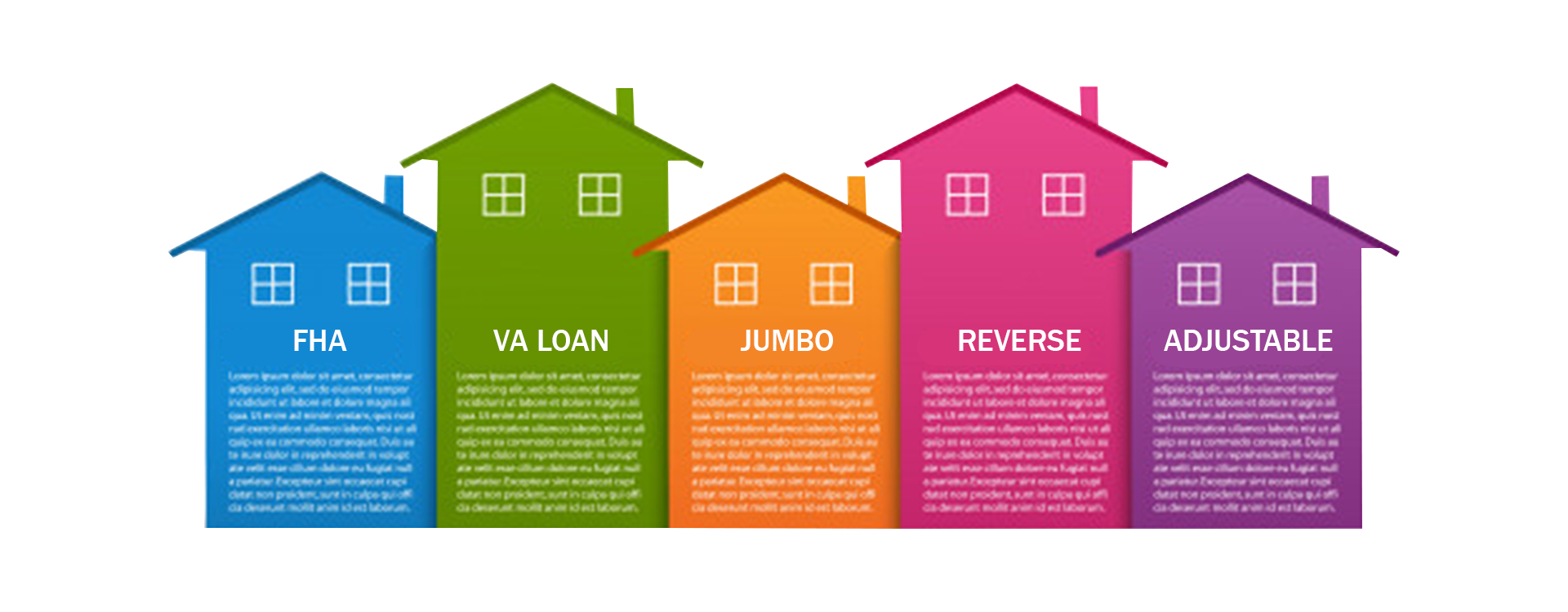

As well as you'll desire several to assess the various deals you're provided. Several customers hesitate before making use of the FHA cash-out refinance, because there's another good choice for FHA homeowners with great deals of equity. However, there's a huge caveat to those Timeshare Organizations low FHA rate of interest. If your financing amount exceeds FHA's limit, you'll Why Would Anyone Buy A Timeshare? need to get approved for a conventional car loan, or possibly a jumbo finance. On top of that, your home loan can not go beyond FHA's finance limits, which currently max out at $420,680 for a single-family home in the majority of the U.S.

Loan provider usually require home mortgage insurance policy on traditional finances with less than 20% down payment or much less than 20% equity. Your financing term indicates the length of time you have to pay off the lending. Shorter term loans have a tendency to have reduced rate of interest, however greater regular monthly settlements. Exactly just how much lower your rates of interest and just how much greater the month-to-month payment will depend a lot on the certain finance term and rates of interest kind you pick. Due to the fact that home mortgage prices are so individual to the debtor, the very best way to locate the rates available to you is to get quotes from several lending institutions. If you're early in the homebuying procedure, make an application for prequalificationand/orpreapproval with numerous lending institutions to contrast and also contrast what they're providing.

The higher costs for the bank can imply a greater interest rate on your home loan. ARM car loans that are in their set period (non-variable state) are not affected by this rise. The exact amount that your rates of interest is decreased depends upon the lender, the type of finance, and the total home mortgage market. Often you may obtain a fairly huge reduction in your interest rate for every factor paid. Other times, the decrease in interest rate for every point paid might be smaller. Each loan provider has their own prices structure, and also some lending institutions might be more or less expensive general than various other loan providers - despite whether you're paying factors or otherwise.

Minimum Deposit Alternative Of 3 5% For Certified Purchasers

Unless you can confirm mitigating scenarios, you can not reduce your waiting time to 3 years. When the housing bubble broke down, it caused extensive delinquencies, foreclosures, and devaluation of housing-related protections. Since their home mortgage equilibrium was more than their residence's value, even if they offered it, they could not pay back their loan. According to on the internet foreclosure business RealtyTrac.com, by 2009, a total of 2.8 million U.S. families obtained repossession filings. Right here is a table listing current FHA home loan rates available in Los Angeles.

Home Mortgage Calculators

Chase's site and/or mobile terms, personal privacy as well as safety policies do not put on the website or application you will check out. Please evaluate its terms, privacy and security plans to see how they apply to you. We make every effort to give you with info regarding product or services you could locate intriguing and also beneficial. Relationship-based ads and also on the internet behavior advertising aid us do that.

Interest rate represents real yearly expense of your financing, consisting of any charges or costs along with the actual rate of interest you pay to the lending institution. Residence purchasers can get approved for FHA finances without having a lengthy credit history or excellent credit history. An FHA home mortgage may call for a deposit as low as 3.5 percent.

Many lending institutions will call for a minimum credit score of 620 to approve a standard mortgage. FHA lendings, alternatively, can be released to customers with a reduced rating. For example, a credit history below 620 would disqualify you from standard home loan authorization.

The fees each loan provider fees can differ equally as long as the rates of interest. So the deal with the most affordable rate might not be the most effective bargain if you're paying too much in advance charges. To contrast prices and also fees, have a look at the Lending Quote kind that lending institutions are called for to provide within three business days of obtaining your application. The Car loan Estimate is a standard type, that makes it very easy to compare quotes. FHA interest rates are commonly lower than standard car loans, before adding FHA home loan insurance coverage to the equation. However, when you include the in advance and yearly home mortgage insurance policy costs, the APRs might make them more pricey than a comparable conventional funding.

It's charged as an in advance cost and as a yearly cost, which is made use of to fund the FHA program. To eliminate this included price, many FHA borrowers ultimately refinance into a traditional home mortgage. Yet prior to they can refinance, they must improve their credit history and also prepare funds for shutting expenses. Refinancing takes prep work as well as financial savings, which is only worth it if you safeguard a much reduced rate